Long time no see, friends! It’s been nearly a year and a half since I’ve posted and I’ve decided to make a comeback. A lot has gone on since I last posted and that has left little time for creative endeavors such as this blog, but now I seem to have a bit more time and energy to devote to this.

We’re already a little over a month into 2017 and what a year it’s going to be! In fact, I’m going to be making 2017 great again… for myself.

Goals for 2017

These are the things I plan to accomplish during the upcoming year.

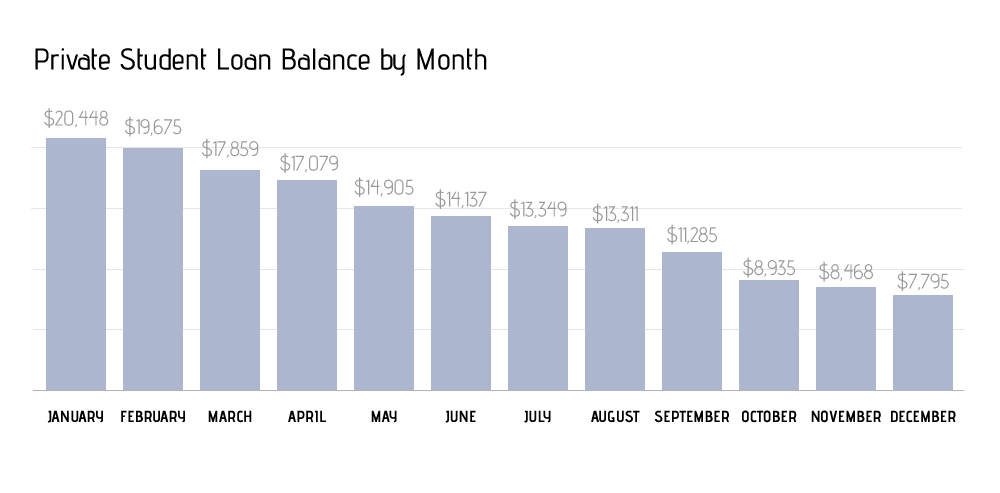

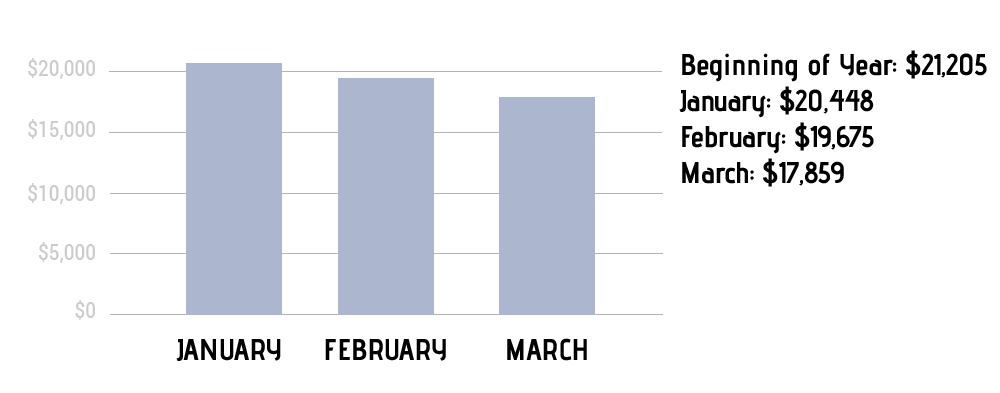

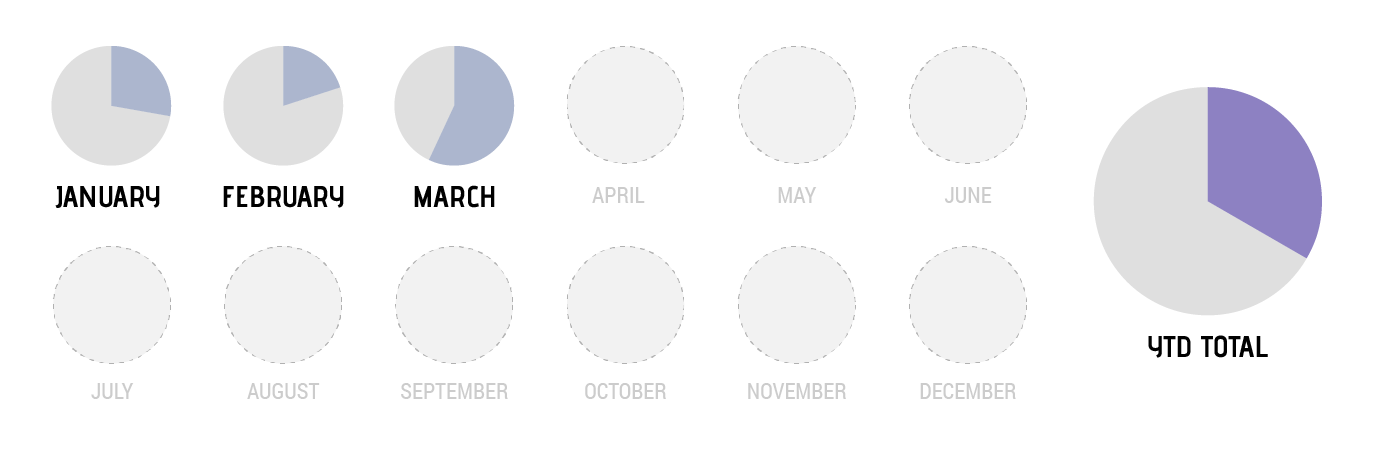

1. Pay off my student loans

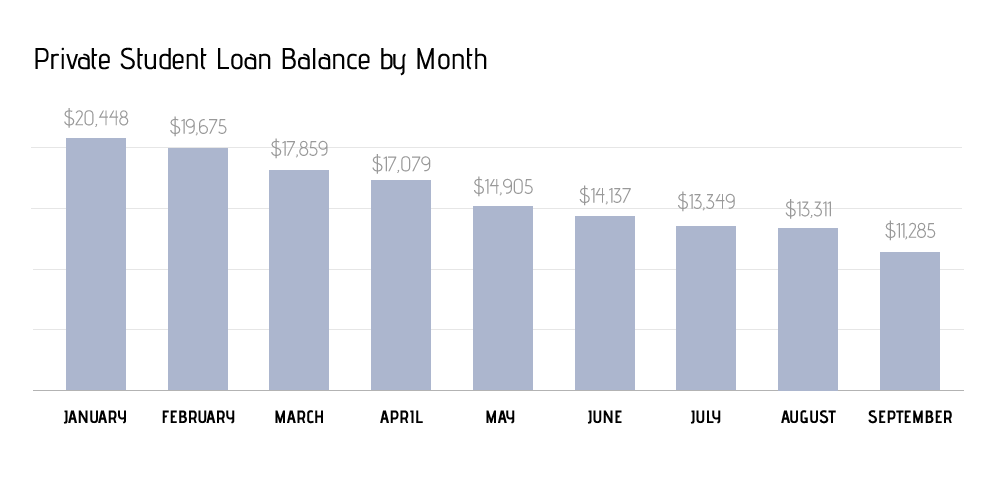

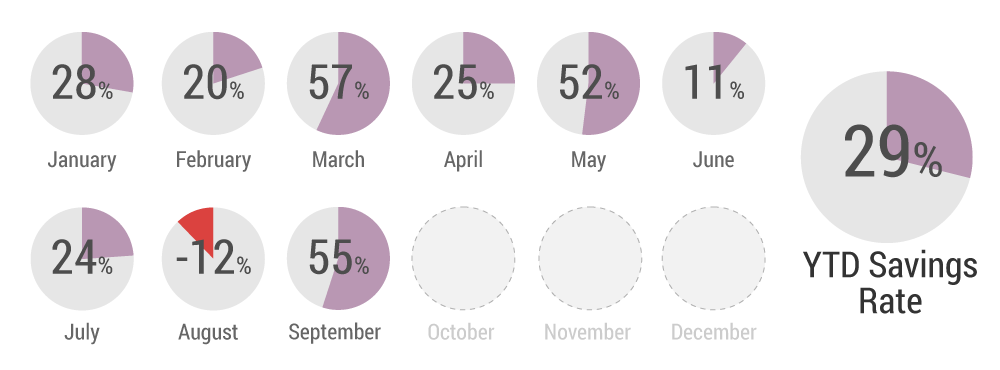

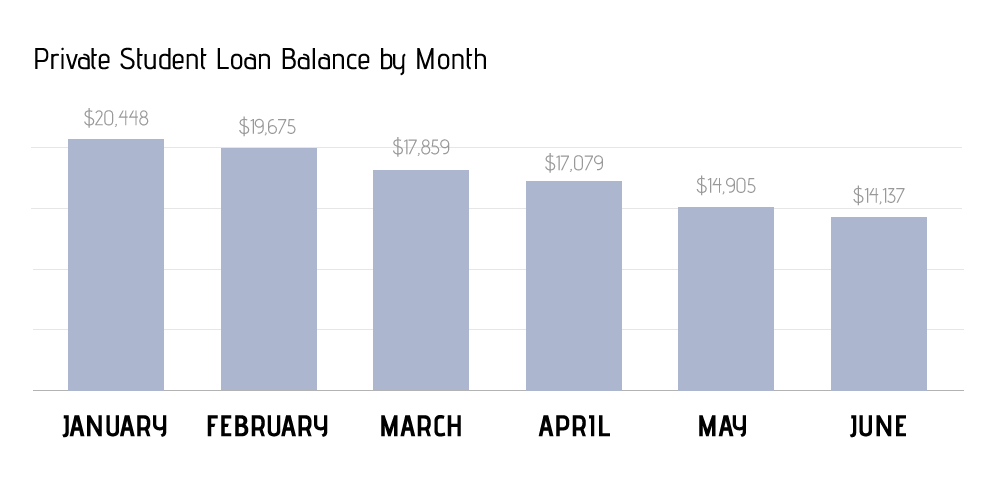

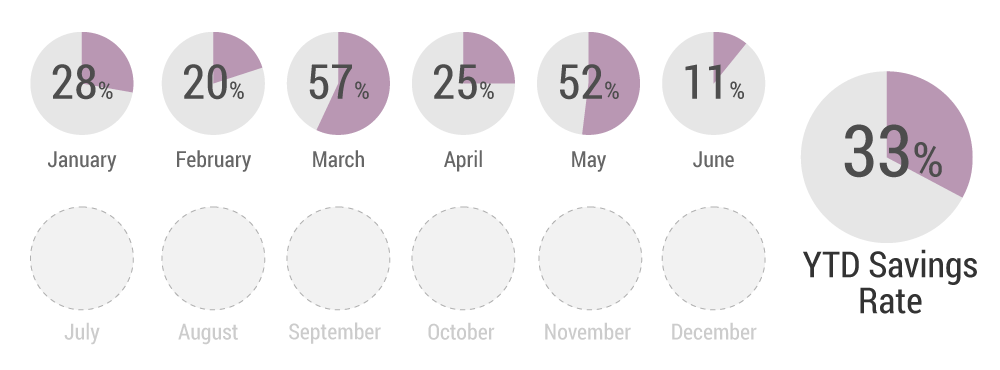

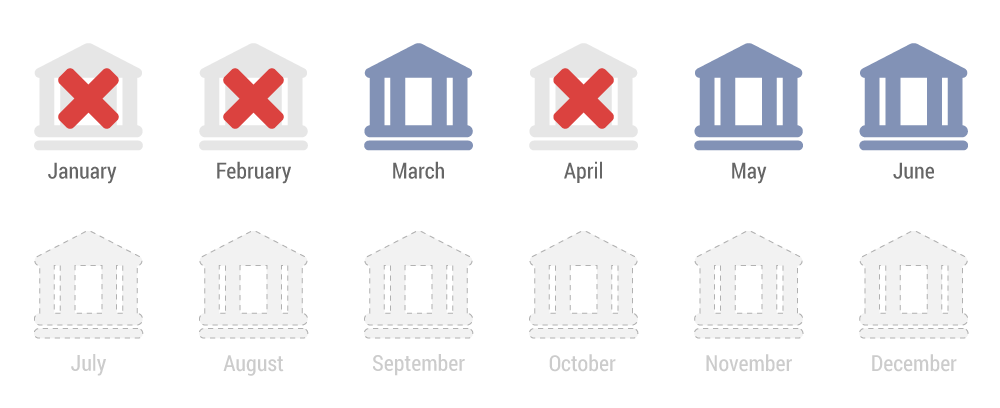

As of today, I have about $28,208 in student loans left to pay. Whether you’ve been following me for a while or you’re new, let me remind you that I started out my student loan journey with over $90,000 in student loans. If you want to be exact, the highest my balance got was $96,000 after interest was added to the principal before I started to repay. I started paying my student loans off in late 2011, so I’ve been able to reduce the balance by $68,000 in the past 5 years (and of course, I’ve paid much more than that due to a pesky thing called interest).

My goal has always been to pay off my loans by the time I turn 30. For various reasons, I won’t make that goal. However, I’m still aiming to have them paid off by the end of my 30th birth year (aka 2017). With interest, I should end up paying about $30,000 towards the student loans by the time I pay them off.

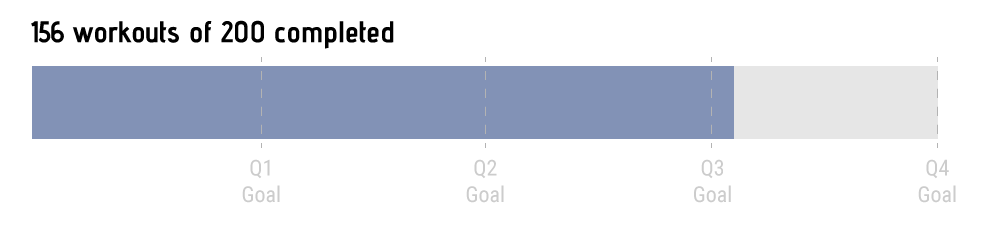

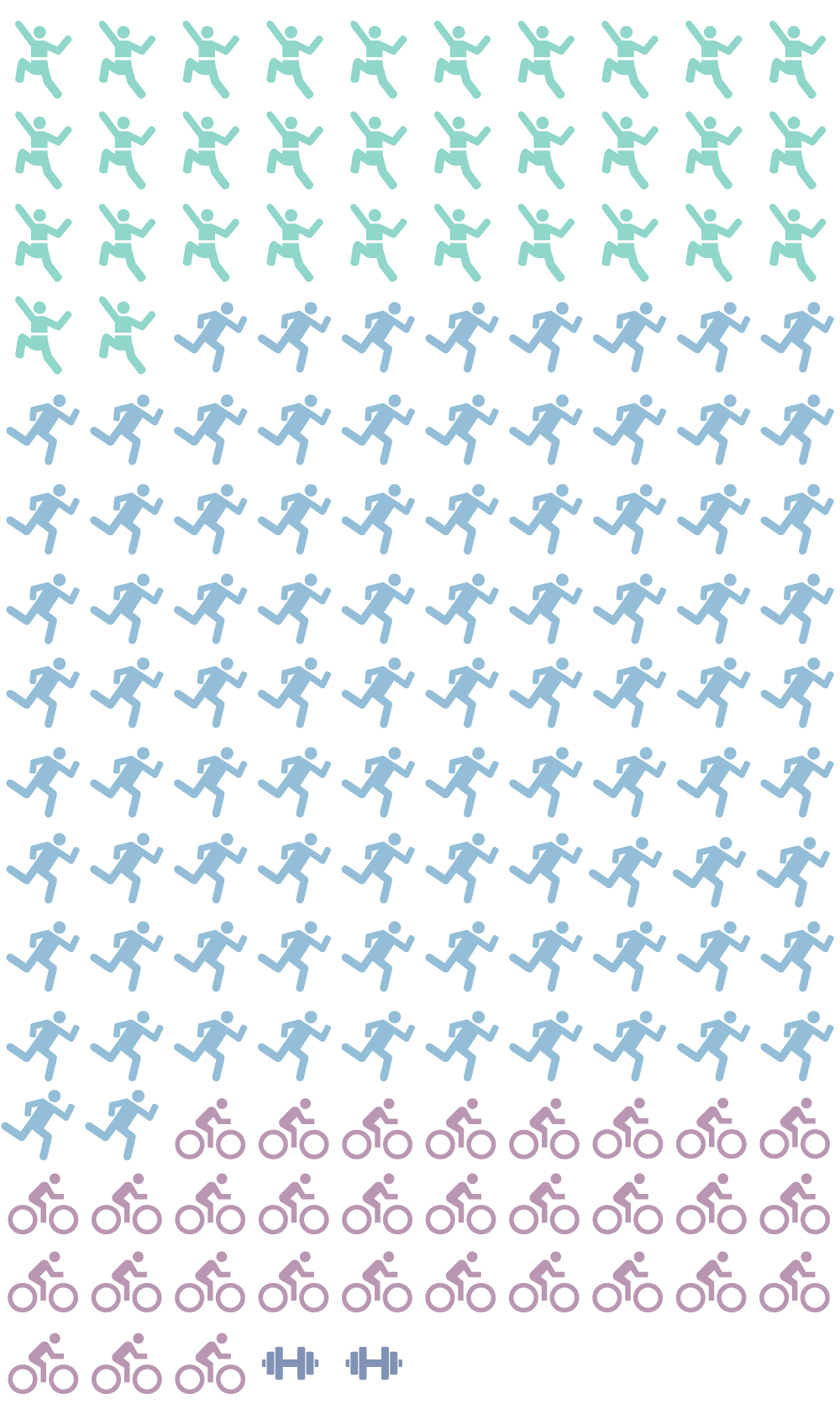

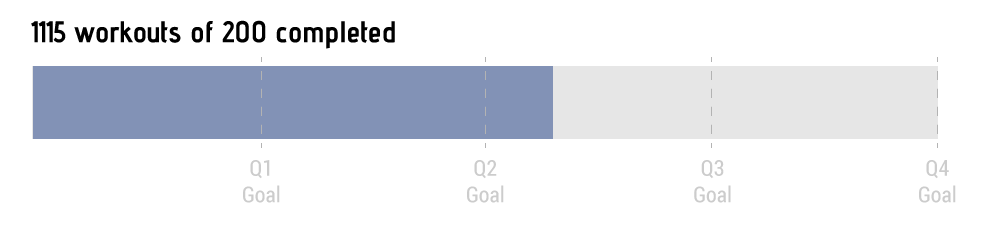

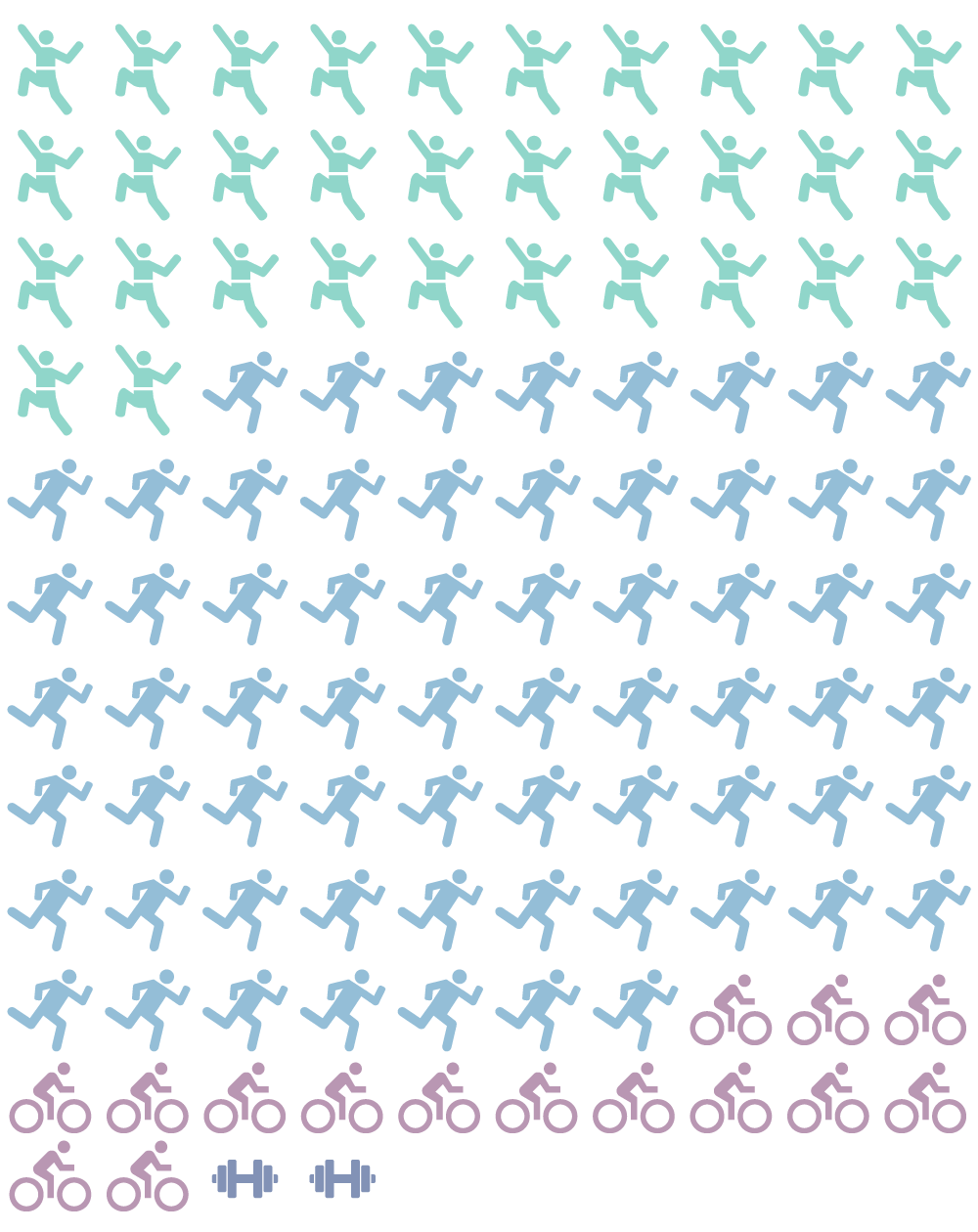

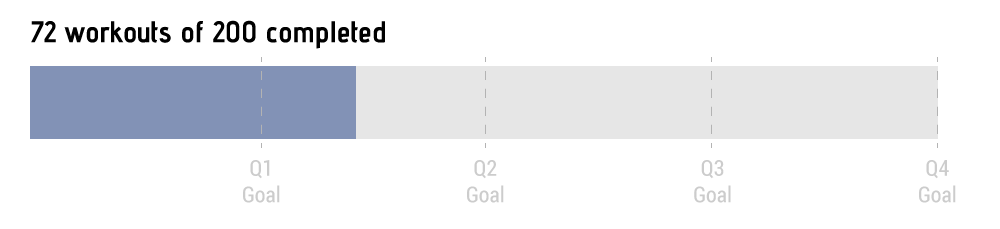

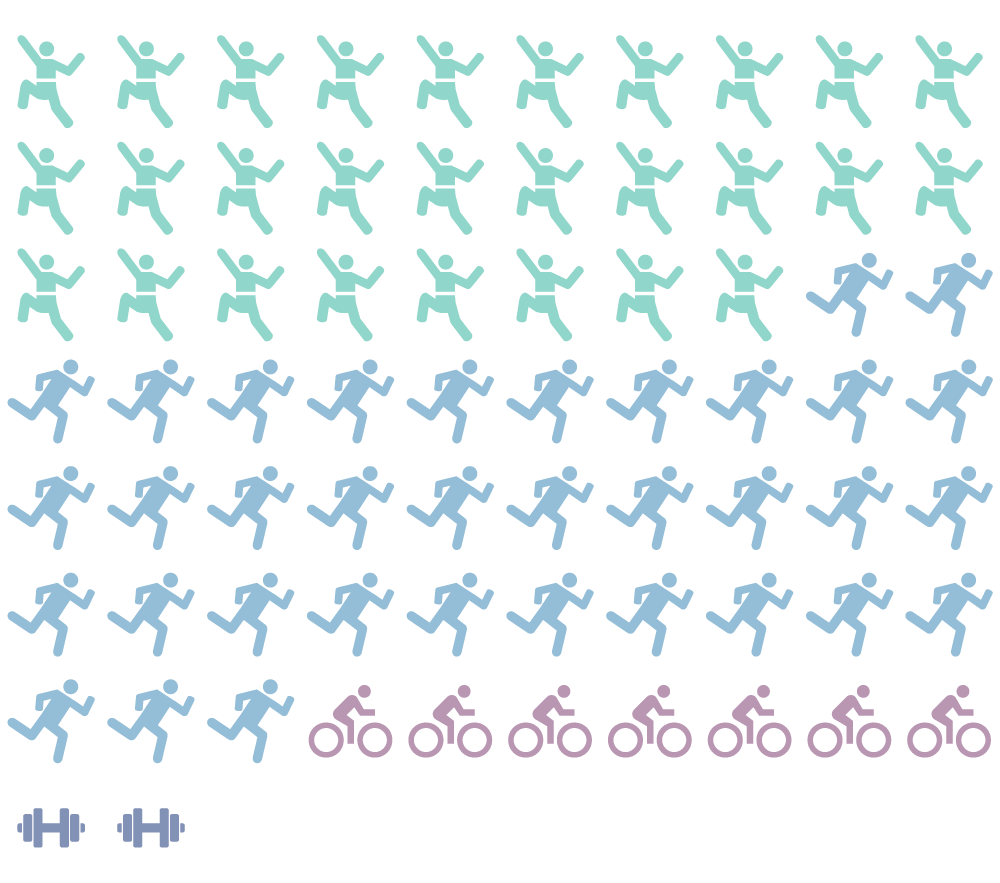

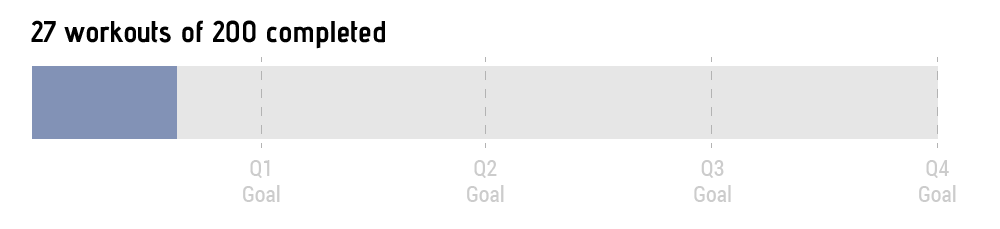

2. Achieve a half marathon or 10 miler PR

In 2015, I made a lot of effort to get back into running. Unfortunately, getting back into running resulted in me developing IT band issues, which resulted in several months of physical therapy at the beginning of 2016. I ran in two half marathons in 2016. My speed was abysmal for the first half and better, but not great, for the second.

My plan is to run at least 1 half marathon this year and 1 10 miler (Cherry Blossom 10 Miler) and PR in at least one of them.

3. Do something(s) big and crazy (aka get married with 2 months notice and move to Germany!)

Now that I can finally see the light at the end of the tunnel of my student loans, it’s time for me to start thinking about what life looks like post-student loans. What will I do once I’m not contributing a large portion of my paycheck each month to student loans?!

More to come in upcoming posts, but Richard and I have made two huge decisions in the past few months. The first decision we made is that Richard wants to return to school to get his PhD… in Germany! More to come on this, because we haven’t solidified all of the details yet, but we’re looking to move to Germany in the next two months for him to start his PhD work. The second thing is that we decided to get married. And we did! Yesterday! Yep, we’re married. It’s still surreal, but it has certainly happened. And we planned and executed it all in less than 2 months. Needless to say, we’ve been busy for a while.

Multi-Year Goals

This is a new category. There are a number of goals that I have that I want to be able to keep track of over the course of several years. Paying off my student loans has been one of them, but since I’m aiming to have them done this year, it’s not really a multi-year goal any more.

Visit all 50 states by the time I’m 35

My current state count is 33. I count all states that I remember setting foot in. This means that I don’t count one or two that I know I’ve been in, but don’t remember because I was too little. The other requirement that I have for figuring out if I’ve been in a state is that I either did something specific there, ate a meal there, or stayed overnight. Airport layovers and driving straight through a state do not count.

We are planning to be out of the U.S. for at least 3 years, so we may not make too much progress in that time, but I want to track it regardless.

Visit all EU countries by the time I’m 35

My current EU count is 7 countries (UK, France, Germany, Spain, Belgium, Austria, Italy). In Germany, we will be in the center of the EU, so I think we will be able to fit a lot of travel in while we are there. Since I know I won’t make too much progress on U.S. states while we’re abroad, I figured trying to get all of the EU countries would be a good equivalent. It will also push us to really make the most of our time living in another country.

Making My Year Great

To be honest, 2016 year was a rough one – both personally and from a larger societal perspective. It didn’t start out all that great, but things are looking up (despite the results of the election and the beginnings of the Trump administration). This year, I’m determined to make my year great. I turn 30! I will have my loans paid off! I can start to think beyond this huge, multi-year goal that I’ve been working towards! I’m married! I’m moving abroad!

Looking back, I have to say that 2012 was my best year. I quit a job that I hated. I started a new career that fit me much better. I met Richard. I moved a couple of times. I won the MyMoneyAppUp Challenge. I think it was my best year, because I took risks and I pushed myself out of my comfort zone. Those actions paid off.

Quitting my job was scary without having something full time lined up. Switching to a new career was scary because although I knew it was a good fit, I didn’t know how good I would actually be. I didn’t know if my application for MyMoneyAppUp would go anywhere, but I did it anyways. I didn’t know if I would be staying in Rochester very long, but I ended up going on OKCupid anyways. I didn’t know that a long distance relationship would work, but I tried it anyways.

I want to inject more of those types of actions into my life this year. I feel rejuvenated and committed to making these types of decisions. Time will tell how they turn out…