One of the big questions for moving abroad that has been plaguing me for a couple months now is: What should we do with all of our stuff? Should we sell it all and start fresh in Germany? Or should we try to ship it over?

I’ve been trying to make this decision from a couple of lenses:

There are different levels of options: we can sell most things, we can bring most things, or we could find some happy medium. First, let’s start with what amount of stuff we’re even talking about.

What We’d Bring (or Sell)

We currently live in a 750 sq ft 1 bedroom apartment. We have a small storage unit down the hall from our apartment and also keep a number of items stored at Richard’s parents’ house. I like to think that we don’t have too much stuff, but things can really add up when you start to investigate what is in all of your drawers and nooks and crannies. A few months back, I did a sweep of our stuff after reading the Life Changing Magic of Tidying Up. We got rid of a lot of things, but there are still many items that probably could go.

What we won’t bring

There are a number of items that we know right off the bat that we will not bring with us when moving abroad, due to various reasons:

- Electronics with plugs – Germany and the U.S. have electrical systems that run on different voltages. That’s why you need converters and adapters when you go over to Europe on vacation. Our TV (which is super old anyways), kitchen electronics, scanner, hair dryer, straightener, air purifiers, printer and lamps will not be coming with us. We will sell most, but store a couple of items like our KitchenAid mixer, CrockPot, and wine fridge.

- Cars & motorcycle – Each of us had one car plus Richard has a motorcycle. We won’t be bringing any of these. We’ve already sold one car and plan to sell the other two vehicles before we leave. We figure that it is not worth the hassle or cost to bring them over. Plus, we are moving to a city that has excellent public transportation. We’ll be living the car free life for a while.

- Couch – We have a fairly compact couch that we purchased from IKEA when we moved to Virginia a few years ago. We like it, but we have no idea what our new apartment is going to look like. We don’t want to risk moving a fairly inexpensive couch that we might not be able to fit into our new place.

- Childhood mementos and most photo albums – I’ve been lugging a few boxes around with me that include childhood momentos. Richard is working on whiddling his down to a couple boxes as well. These will be safe and sound at Richard’s parents house while we are exploring Europe.

- Plants, flammables, and other restricted items – There are a number of things that you aren’t allowed to bring with you to a new country. Plants and flammables are the most relevant to us. Firearms and porn are also on the list of prohibited items, but those don’t really apply to our situation.

- Consumables, personal care items and cleaning supplies – We don’t need to bring toilet paper, cleaning supplies or things like shampoo with us.

What we will definitely bring

- Original university degrees, transcripts, birth certificates, marriage certificates and other documents – Germans are big on actually seeing your flesh and blood documents. We’ll bring these with us.

- Pet – Zeke will be coming with us to Germany! Unfortunately, Stella has a terminal illness, so she won’t be making the trek with us. Now let me go cry a million tears…

- Plates, flatware, and glasses – We just received some new kitchenware as wedding gifts and we have quite a collection of wine glasses. We’re planning to bring these along with us since they are rather compact and mean a lot to us.

- Clothes – We’ll probably trim down to the necessities, but we have no plans to trash what we’ve got and start over. We’ll slowly assimilate to dressing like Germans as we buy new items there.

- Computers and small battery- or USB-based electronics – We’ll be able to bring our computers and a number of small electronics like our cell phones, electric toothbrushes, and a few other items.

What we’re still deciding on

So we have a number of things that will come and a number that won’t, but we also have a number of things that we’re not sure about yet. We couuuuuld bring them, but we could not bring them.

- Dressers and other small furniture

- Picture frames and other decor

- Bookshelves

- Office chair and desks

- Bicycles

- Extra mattress and bedframe

- Books, DVDs, and other media

- Wine

- Mattress, bedframe and bed linens

- Dining table

Our Moving Options

So that’s all of the stuff we’re talking about. We basically have a few options for moving things:

- Move stuff by sea in a 20 ft container

- Move stuff by sea in a small cube (200-300 cu sq ft)

- Pack everything in suitcases and bring as excess baggage on the plane

- Ship items in one off boxes through USPS, FedEx or UPS

These options vary in terms of their cost, ease of coordinating here vs. there, and timing that we would receive our options. Let’s take a closer look at each option.

Moving Stuff by Sea

The first two options involve putting all of our belongings onto a ship and sending them over to Germany by sea. The initial quotes that I’ve received have been anywhere from $2,000 – $6,000. The final cost depends on how much you send, what services are included, and various port and agent charges. Logistically, there are some important things to consider:

- Timing – It can take a long time to ship items by sea. We would need to go a period of time before we leave and after we arrive without the items that we ship. This may not be a big deal for some items that we ship that we don’t use everyday. However, for an item like a bed, that would mean we would have to figure out where to sleep for 6 to 8 weeks. The time estimates are also not guaranteed. Your stuff could arrive earlier than expected, but it could also arrive later than expected.

- Packing – Packing and inventorying of our items is included in the price. If we ship our stuff, we want to leave the packing up to the professionals. There are a lot of rules and regulations of how you need to document your items for customs officials, so it will be infinitely easier and more efficient for someone else to handle that dirty work.

- Flexibility for Volume – You have a lot of options when it comes to how much you can ship. We can ship a few of our items or we can ship a larger load in our own 20 ft container. This gives us some flexibility around choosing the most cost efficient option for us.

- Cost – $6,000 is a lot of money! Plus, if you lug it there with you, you will eventually need to bring it back to the U.S. Do we really think the things we’re planning to ship are worth the $12,000 it would cost to bring them there and back? For the most part, we’re still in the IKEA phase of our furniture lives, so this is a very legitimate question. There can also be fees that spring up when the items get to the new country with customs and the port.

- Finding a Vendor We Can Trust – If you’ve ever googled an international moving company, you’ll understand that these websites are like the wild west. It’s impossible to get a straightforward quote. No one has positive reviews. It’s confusing. I’m really nervous about picking a mover and then having it turn out poorly because I didn’t think to ask the right question or I just got unlucky.

Bringing Excess Baggage by Air

If we want to completely get around finding an international mover and dealing with all of that, we could try to bring our stuff with us on the plane as excess baggage. Like sea, there are important things to consider with this method of moving:

- Timing – Our stuff would be with us, so we wouldn’t have to worry about not having the items to use while they are in transit.

- Cost – Excess baggage can be expensive, but depending on how much we bring with us, it could still be less than the cost of shipping things by sea.

- Lugging our stuff – Our plan is to fly into Frankfurt and take a day to settle down. Then we will take the train from Frankfurt to Hamburg. We are doing this because we will have Zeke with us and we figured that they will want a break from travel before we make it to our final destination. If we bring our items on the plane with us, we will need to lug them on the train with us. This may prove to be rather difficult, because I do not think any of the trains in Germany have baggage cars.

- Flexibility for Future Trips – We have the option of bringing a few luggage items with us and then having visitors bring additional ones for us at a later time. This will possibly be a good option for the items that we are fine living without for a few months, such as decor items and other nice to haves.

- Safety of stuff – A major risk with bringing stuff with us on the plane is that baggage handlers aren’t exactly known for their light hand with handling luggage. If we bring fragile items, we are at the mercy of the baggage handlers who may or may not be throwing our luggage around while we’re not looking. Do we want to take the risk of trying to pack our silverware, plates, and wine glasses in our luggage or just trust them on the open sea?

Cost Analysis

I mentioned that we want to make a decision about what to do based on cost, logistics and sustainability. Cost is easily going to be the biggest predictor of what we do. So how do we measure the final cost? Well, that’s what is a little unclear, but I think I can figure it out. First, let’s start with our known and set costs.

Things We Know We’ll Need to Buy

There are things that we won’t bring with us, so there are things we know we’re going to need to purchase when we get to Germany. Here are some high level estimates to get us started. Most of the prices came from IKEA and Amazon.de.

- TV – ~$1,000 depending on what model we want to get

- TV Stand – $100

- Couch – $600 gets us a similar IKEA couch to what we have now

- Toaster Oven – $75

- Hair Dryer – $35

- Air Purifier – $400

- Lamps – $200

- Consumables & cleaning supplies – $200

- Bathroom accessories & toiletries – $100

- Laundry basket & rack – $40

- Clothes hangers (wood & plastic) – $50

- Trash cans – $50

- Wall & alarm clocks – $20

- Side tables – $60

- Wardrobe – $600 Apparently a lot of apartments in Germany do not have a closet. We may need to purchase ourselves a wardrobe. Hopefully we won’t need one of these, but it’s on here just in case.

- Coffee maker & grinder – $100

- Drinking glasses – $20

Total: ~$4,000 (I rounded up because I tend to underestimate these types of lists)

Things We Might Need to Buy

- Dressers – $500 will get us a nice set of Hemnes if we decide we don’t want the bottom of the barrel IKEA options.

- Desk & Chair – $300 will get us a nice desk chair and a simple IKEA desk

- Litter box unit – $200 to replace the cat litter station I built for Zeke when we moved to Virginia

- Bookshelf – $100

- Night stand – $40

- Dining table – $200

- Dining chairs – $200

- Mattress & bedframe – $2000 for a comparable mattress and bedframe if we decided to just start over

- Bicycles – $300 assuming we can get some decent secondhand bicycles

- Rug – $50

- Decor and other items – $200 to get us started

- Pots & pans – $300

- Towels & other linens – $200

Total: ~$4,500

So, what’s the best way of estimating this? I’m not actually sure to be honest. It’s not a clear 1-to-1 on what we will bring vs. not bring and what we will need to buy vs. not buy. We have the option to sell some of our items here in the U.S., which will affect our overall net cost. We also are not planning to replace every item that we sell or leave behind in Germany.

Scenario 1: Ship ~200 cu ft of items

Let’s assume we decide to ship the following:

- Mattress, bedframe, bed linens

- Dining table

- Plates & flatware

- Wine glasses

- Pots & pans

- Winter items

- Extra pet items

- Some decor

- Physics books

- Computer

- Speakers

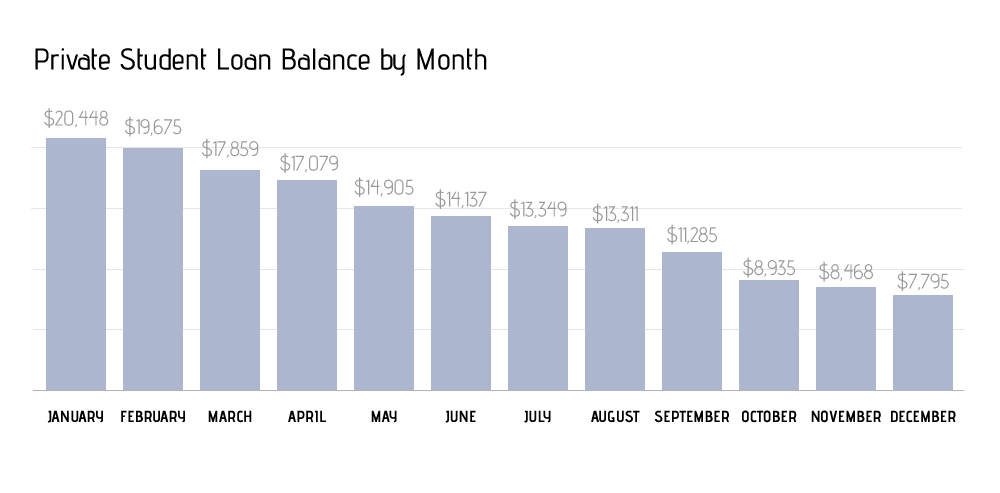

Total cost of shipping: $5,000 (excluding insurance)

We would bring the following with us on the plane:

- Clothing

- Toiletries

- Pet items

- Living essentials

Let’s assume all of these items fit into two large and 1 small checked bag, 1 carry-on, 1 pet carrier, and 2 bookbags.

Total baggage fees: $100 (our first 2 checked bags are free)

With with both scenarios, we know we’ll likely be buying up to $4,000 worth of items, regardless if we ship a lot or a little. Additionally, we would need to purchase dressers, desk, computer chair, litter box unit, bookshelf, night stand, dining chairs, bicycles, rug, and additional decor. This will likely run us another $2,000.

In total, shipping, luggage fees, things we’ll buy regardless, and things we’ll buy because we won’t ship them will be about $11,100.

Scenario 2: Checked luggage and boxes

Let’s assume we aren’t shipping anything by sea. That means we’ll need to bring everything in checked bags. On the way to Germany, let’s assume we bring 1 carry-on, 2 bookbags, 1 pet carrier, and 2 large checked bags, 1 medium checked bag, and 1 small checked bag.

We’d be able to bring the following.

Large checked bag 1

Large checked bag 2

- Richard clothing

- Sports stuff

- Pet food, litter and supplies

Medium checked bag 3

- Nicole clothing

- Toiletries

- Towels

Small checked bag

Carry-on 2

Bookbags 1 & 2

- Laptop

- Chromebook

- iPad

- Critical documents

- Other electronics

- Travel pillows

- Kindles

Boxes to Ship

- Computer

- Speakers

- Wine glasses

- Physics books

To bring four checked bags, we will spend $200. The cheapest shipping seems to be with USPS. We can ship 50lb boxes to Hamburg for $150 each. Let’s assume we need to ship 5 boxes. That’s puts us at $750.

When we arrive in Germany, we would have a lot of things we would need to buy. We’d need to buy all of the things that we know we need to purchase regardless, which will be $4,000. Additionally, we’d need to buy all of the things in the “we might need to get these” category, which is around $4,500. That puts us at $9,450 to bring what we can in checked luggage, ship a couple of boxes and buy the rest when we arrive in Germany.

Next Steps

We’ve decided to move forward with Scenario 2. We’re going to load up as much as we can in our luggage and then ship a couple of boxes with the rest of our stuff. The cost is cheaper and we have more flexibility to keep the price low (and possibly lower than what I estimated above). Logistically, it will also be easier, because we’ll have our stuff with us and we can bring it through customs rather than having to deal with a port and all of the logistics that come with that. From an effort standpoint, we probably have a little more work since we’ll have to back our shipping boxes ourselves and really make sure we are able to sell, store or donate everything that doesn’t fit in our luggage plus a couple of boxes.

Moving abroad is going to be quite the adventure!