Welcome to my third 2015 goals update! I set some goals that I want to focus on this year and I keep quarterly track of them here. You can check out update 1 and update 2 to see how I’ve been doing this year. Regardless of my denial, we are trucking towards the end of the year and we’re getting farther and farther away from summer weather.

So far, it looks like the only goal I’ll actually achieve is my savings rate. That sounds like a pretty poor year, but I tend to give myself stretch goals anyways. So even though I won’t achieve all of my goals, I’m pretty happy with my progress.

1. Pay off my remaining private student loans

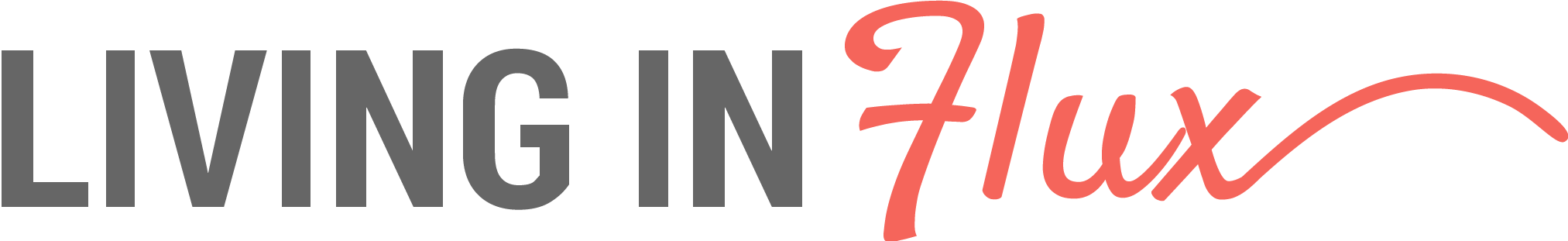

In my last post, I mentioned that my focus for the year is to pay off my two remaining private student loans. I started the year with $21,205 in private student loans (across two loans). I’m now at $11,285.71, which means I’ve paid off $9,920 in principal on my private loans since the beginning of the year! I paid off$2,852 in Q3, which is not as good as what I paid off in Q1($3,346) or Q2 ($3,722).

I’m a bit behind. I’ve paid 53% of the principal I wanted to pay, but I’m 75% of the way through the year. I have a big payment scheduled for October 2 to make a final payment on the first loan. Then I’ll be left with only the second one to pay off before the end of the year. At this rate, I probably won’t have both paid off before the year ends, but I’ll at least have started to make progress on the second loan. I started the year with 3 loans (2 private, 1 federal) that were above the $10,000 mark (don’t forget I started with over $90K and I’m trying to pay them off before I’m 30). Both of the private are now under $10K. I’m excited to see the progress I’ll start to make on hitting off loans once I get through these two.

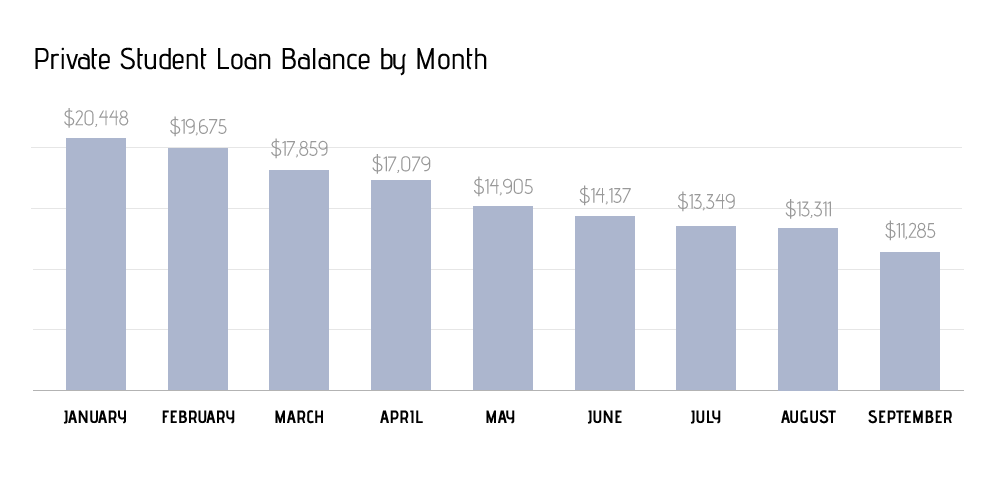

2. Contribute 25% of my take home pay to savings and extra student loan payments

In an effort to make sure I’m staying on track with my savings goals, I am aiming to save 25% of my take home pay this year. This 25% is comprised of savings that go towards my emergency fund and my extra student loan payments.

For the year, I have a 29% savings rate. This is down 4% from Q2. As you can see, I actually didn’t save anything in August, but spent more than I earned. I made up for August’s lack of savings by saving 54% of my take-home in September. October, November, and December all look like they will be good months for savings. I’m hoping to finish out the year at 30% or above.

3. Take at least 20 days of PTO

In an effort to improve my work-life fit, I decided to aim for taking 20 days of PTO off this year. So far, I have taken twelve days of PTO – 97.25 hours to be exact. I took off 6 days in Q3, which doubled my PTO usage for the year. I will likely end the year with another 4 days of PTO, putting me at 16 days for the year.

4. Be a backyard tourist in DC at least once a month

One of my goals for the year is to make a concentrated effort to get out and explore my “new” backyard – I’ve now officially been here a full year. In August, Richard and I went to both the Kennedy Center for Performing Arts and to Great Falls National Park. Despite being a tourist elsewhere for most of the month of September, Richard and I snuck in an outing to a Washington Nationals game last weekend.

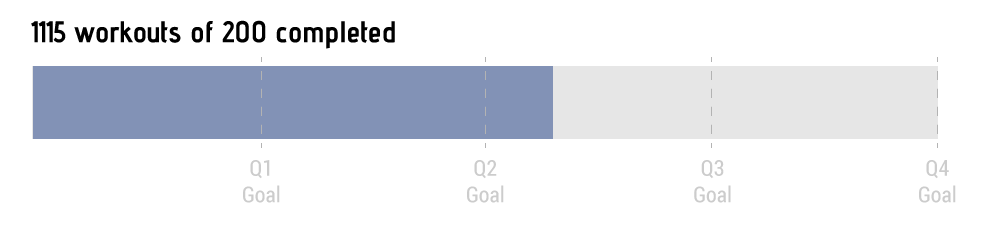

5. Work out 200 times

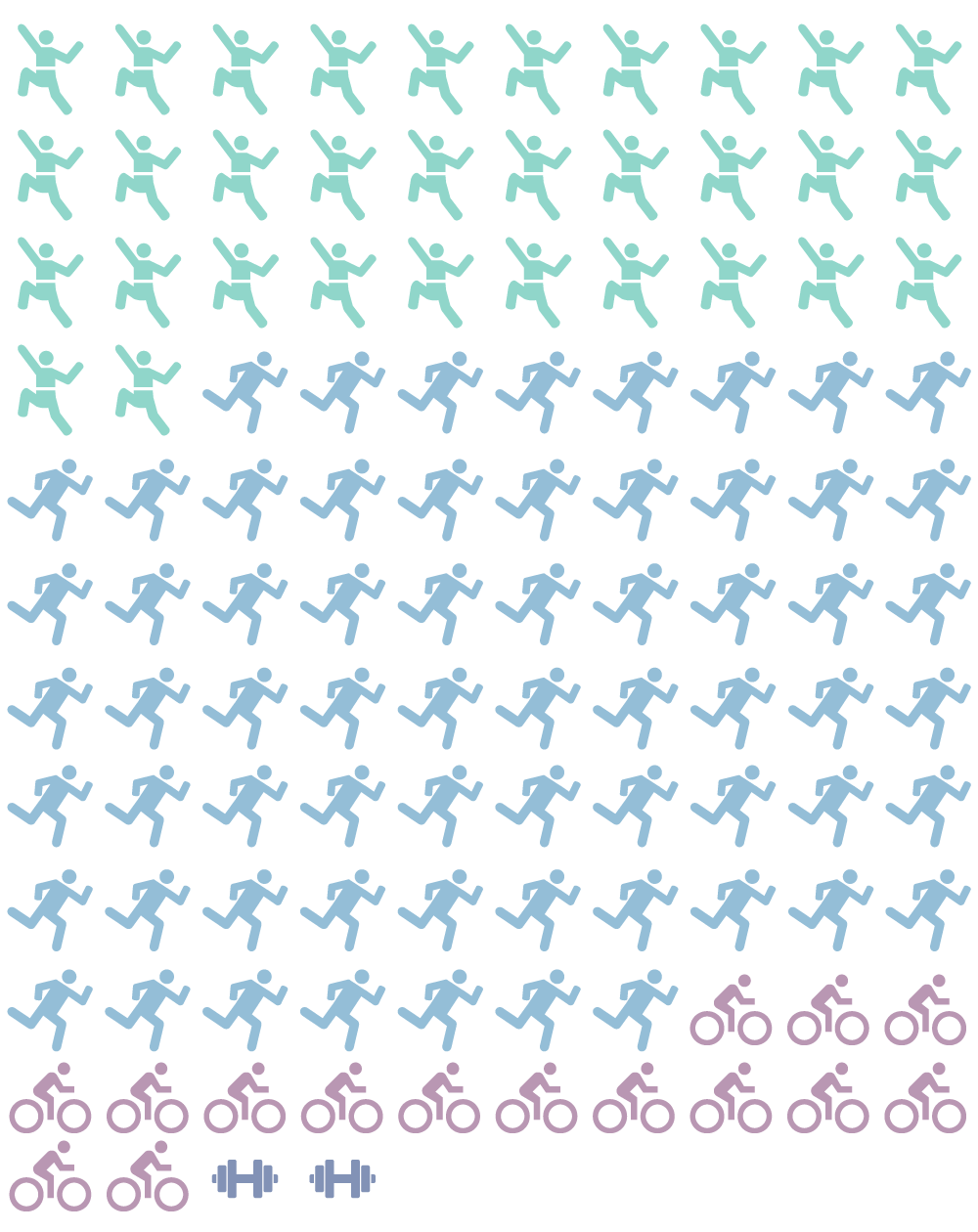

In an effort to focus on my health and fitness, I decided to add a workout-focused goal. I didn’t articulate this goal until February, so I’m a little behind the game. So far this year, I’ve worked out 115 times in 2015. This is up 43 workouts since the last time I posted. It’s pretty unlikely that I’ll catch up, but I’d be impressed with anything considering last year was an abysmal year for me working out.

If you’re interested in a breakdown of how I’ve been working out: I’ve bouldered/rock climbed 32 times, ran 65 times, cycled 15 times, and lifted weights twice.

2015 Goals Update: Almost There

Overall, I’d say that things are looking good! As I said, I’m probably only going to achieve my savings rate goal. But I’m okay with that! I’ll be back in three more months to give the skinny on where I landed. I can’t believe it’s almost time to come up with new goals!

How are you doing on your yearly goals?