I turned the big 2-8 last week. That means that I have two years left to acheive my longstanding goal of paying off my loans by the time I turn 30.

As of right now, my balance hovers around $55,000. Oof. That’s a lot of loans to pay off still. On the flip side – let’s celebrate the fact that I’ve paid off over $35K in principal on my loans since I started paying them off in late 2011!

Considering that I’ve only paid off $35K over 3.5 years and I want to pay off the remaining $55K over 2 years, it seems like it might be a tight two years. So, let’s look at the numbers.

What Paying Off $55K of Student Loans in 2 Years Looks Like

I decided to pull out my trusty debt repayment calculators, Unbury.us, to do a quick and dirty calculation of how much I need to contribute each month (on average) to achieve my goal.

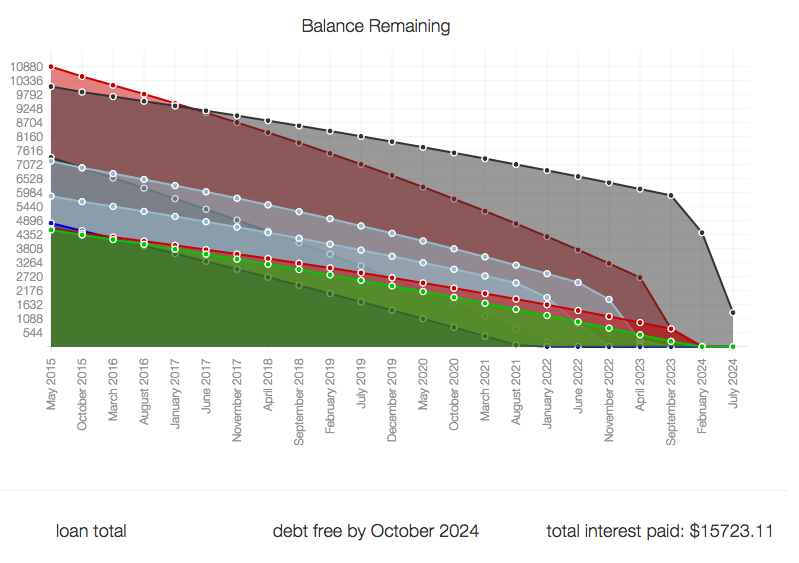

Minimum Payments Only – Debt Free by July 2024

If I were to only pay the minimum each month, I would be paying on my loans until 2024. That means I would be 37! That’s 7 years longer than I’m aiming to pay. Also notice how much interest I would be paying. I could buy myself a modest used car with that amount of interest!

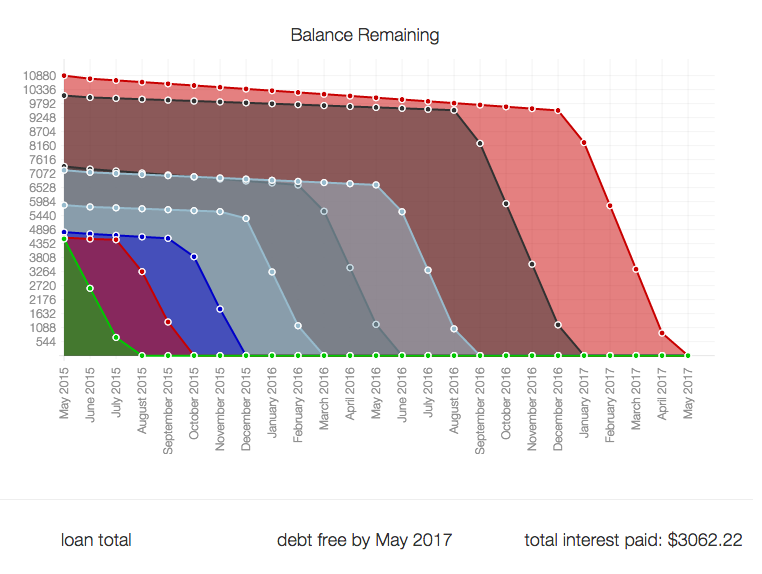

Debt Free by May 2017 – $2500 per month to student loans

Minimum payments isn’t the world I live in though – I’ve been paying extra each month to help me achieve my goal. My quick calculations suggest that I need to contribute $2,500 per month to student loans in order to have them paid off by May 2017.

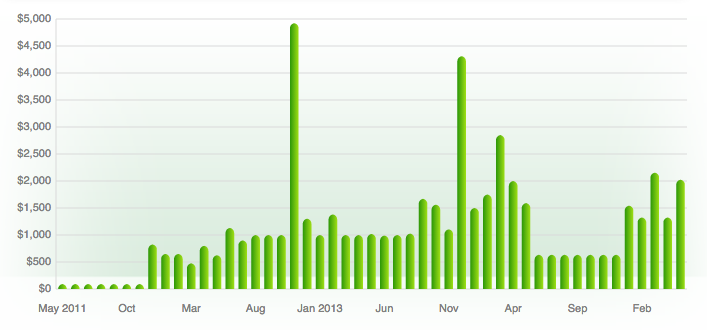

Unfortunately, my student loan payments aren’t anywhere near $2500 per month at this point. Here’s a graph of my student loan payments over time since May 2011.

As you can see, I generally hover around a set amount per month with some months where I contribute a bigger chunk. Last year, while I was preparing to move, I took a break from paying extra and only contributed the minimum. Now that I’m settled in a new location with a higher paying job, I’ve been upping my payments again.

Moving Forward

I’ve been struggling for a long time with the basic debt reduction calculators that I’ve found online because they don’t give me the flexibility to choose the exact order I want to pay my loans off in and they don’t allow me to enter/account for one-off payments.

Much of my strategy, as you can tell from my chart above, has been to have a hefty payment each month and pay bigger chunks when I can (e.g. tax refunds, bonuses, etc.). Luckily, I finally found the answer I was looking for – the most comprehensive debt reduction calculator ever from Vertex42. It allows me to choose what order I want to pay off my loans and most importantly, it allows me to account for what they call “snowflaking” – adding in one-off payments above what I generally pay.

My Strategy for the next two years

Overall my strategy for paying off my loans will be this:

- Maintain base level of overpayment each month

- Increase base payment when my compensation increases (hopefully by $300 per month this year and then again next year in September when our salary increases go through)

- Contribute 70% of windfalls (bonuses, tax refunds, etc.) to student loans in addition to my regular monthly payment

- Treat third paycheck in three paycheck months (2 per year) as a windfall

- Pay off my private loans (since they are higher risk) then move on to a snowball avalanche approach where I’m paying off the lowest balance of the highest interest rate first

A Note About Assumptions

Planning out two years of payments is a tricky game. I’ve tried to be conservative but also realistic at the same time in my estimates. So much of my ability to pay off these loans in two years will be determined by a few key details such as my compensation (I’m assuming it will increase, but I do not know by how much) and my windfalls (I’m assuming I will receive windfalls of a general size, but I won’t know until I receive them).

For example, when I plug my numbers into the debt reduction calculator/spreadsheet, I’m able to finesse them to get me to a May 2017 payoff date. However, it’s still wildly unclear how accurate those windfalls and numbers will be.

Will It Happen?

So, in sum, it’s looking like it’s in the realm of possibility, but it will be tough for me to pay off my loans in two years time. It’s really all going to come down to how much my income increases and how much I will get for bonuses and such. The good news is that it’s not a “hell no” at this point. I just need to keep on keeping on as I have been for the last few years by paying what I can regularly and pumping extra money into my loans when I come across it.

Hopefully, if you’re in the same or a similar boat as me you find these calculators useful for estimating how and when you’ll get all of your debt paid off.

What are your debt repayment goals?