Welcome to my final 2015 goals update! We are already a bit into 2016, so I figured it was time to do a final recap of how I did on the goals I set for myself last year. You can check out update 1, update 2 and update 3 to see how I fared throughout the year.

So far, it looks like the only goal I’ll actually achieve is my savings rate. That sounds like a pretty poor year, but I tend to give myself stretch goals anyways (see my previous yearly goal results and you’ll see what I mean – 2012, 2013, 2014). So even though I won’t achieve all of my goals, I’m pretty happy with my progress.

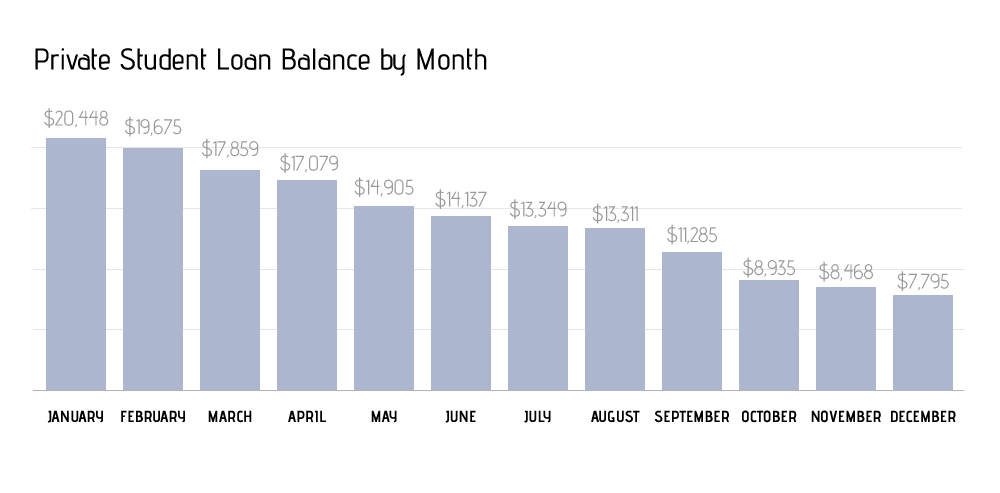

1. Pay off my remaining private student loans

My focus for 2015 was to pay off my two remaining private student loans. I started the year with $21,205 in private student loans (across two loans). I, unfortunately, didn’t achieve my goal and I ended the year with $7,795 in private student loans. Even though I didn’t achieve this goal, I think I did pretty well, considering I paid off $12,653 in principal on my private loans throughout the year! The following is a breakdown of how I did per quarter:

- Q1: $3,346

- Q2: $3,722

- Q3: $2,852

- Q4 $3,490

This past quarter wasn’t my best, but it was a pretty good end to the year. Now, on to 2016 and getting that pesky private loan paid off within the first few months of the year.

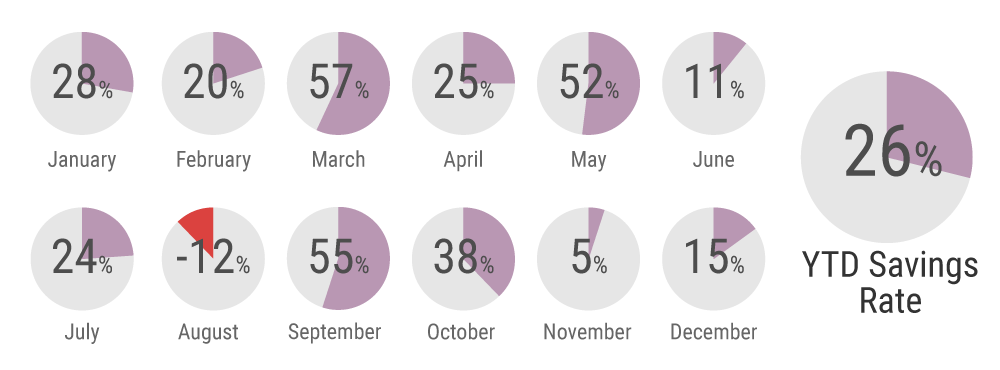

2. Contribute 25% of my take home pay to savings and extra student loan payments

In an effort to make sure I’m staying on track with my savings goals, I aimed to save 25% of my take home pay this year. This 25% is composed of savings that go towards my emergency fund and my extra student loan payments.

I finished the year with a 26% savings rate. I not only achieved my goal, but exceeded it! The last quarter of the year wasn’t all that great when you look at November and December. However, this game wasn’t won in the last two months of the year. My discipline throughout the year is what allowed me to come in over the finish line successfully.

3. Take at least 20 days of PTO

In an effort to improve my work-life fit, I decided to aim for taking 20 days of PTO off this year. I took 16.5 days off in 2015. It’s not 20, but it is over 3 work weeks of vacation.

4. Be a backyard tourist in DC at least once a month

I royally failed with this goal. No DC backyard tourism during the last 3 months of the year. I think next time I do a goal like this, I need to identify the activities that I want to do before I actually set the goal. I think that would have helped me be more mindful about achieving it.

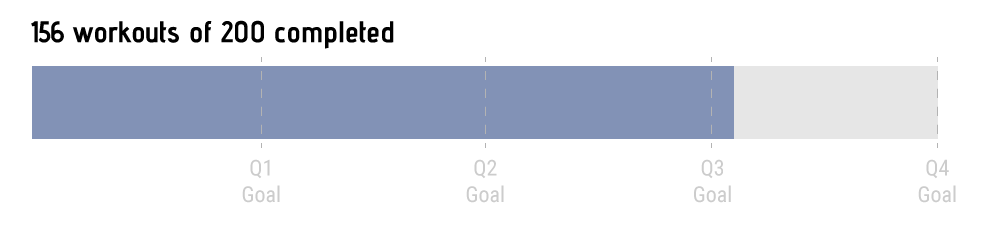

5. Work out 200 times

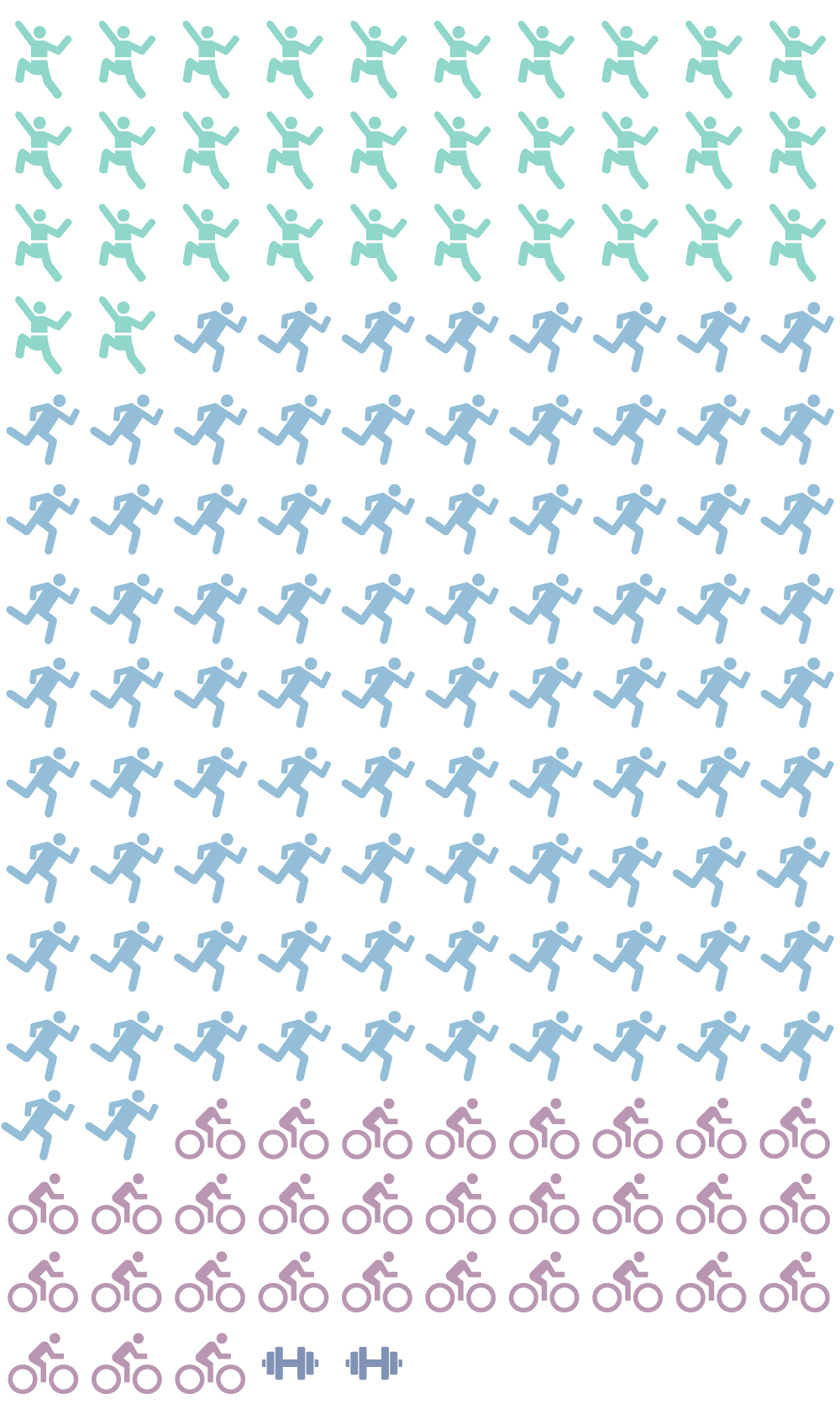

In an effort to focus on my health and fitness, I decided to add a workout-focused goal. I didn’t articulate this goal until February, so it took some catching up. I ended up working out 156 times in 2015. I didn’t achieve my goal, but 2014 was an abysmal year for working out, so I think I would have ended up being happy with any sort of substantial workout activity. Now to keep the momentum going!

If you’re interested in a breakdown of how I’ve been working out: I’ve bouldered/rock climbed 32 times, ran 90 times, cycled 31 times, and lifted weights twice.

2015 Goals: A semi-success!

The only goal that I actually met was my savings rate. I consider the private loan progress, workouts, and days off great efforts and don’t consider them failures in the slightest. Trying to haphazardly do DC tourism was a fail. Now on to 2016!

How did you end up doing on your 2015 goals?