It’s that time of the year again: tax time! I spent a large portion of last weekend preparing and filing my taxes. This was my first year trying out online tax software, so I figured I would test the waters at each of the big online tax software websites and see which one was most appropriate for me and my situation. And now I’m sharing it with you, so if you’re not sure where to start, you have a concise overview of the options available to you.

I think it goes without saying, but I’m no accountant. While I do have some experience preparing tax documents for a former part-time job, I’m certainly not an expert and nothing below should be viewed as tax advice. My goal is to provide you information about the different online tax filing websites to help you figure out what might be a good starting point for yourself.

I reviewed three popular tax sites: TurboTax, H&R Block Online, and TaxACT. Before I get into the nitty-gritty of what I found, let’s take a look at who the contenders are.

The Online Tax Filing Contenders

TurboTax

TurboTax by Intuit (the folks who bring you QuickBooks, Quicken and Mint.com) is touted as the way for you to “get your taxes done right.” If you’ve heard of any of the tax filing software that’s available, you’ve probably heard of TurboTax.

TurboTax offers four different tiers, organized by price and circumstances (or tax forms) apply to you:

- Free – For simple tax returns that utilizes the 1040EZ form; best for students and first-time filers; federal is free, state is $27.99

- Deluxe – Walks you through deductions, so it’s good for people who itemize; federal is $29.99 and state is $36.99

- Premier – Good for people with investments and rental property; federal is $49.99 and state is $36.99

- Home & Business – Made for people with small or home business (including freelancers) or home office deduction; federal is $74.99 and state is $36.99

H&R Block

H&R Block provides an online tax filing service so that you do not need to go into an H&R Block location to file your taxes with a live accountant. Similar to TurboTax, they offer four tiers that are organized by price and tax situation:

- Free – Best for first time filers; federal is free, state is $27.99

- Basic – Good for those with simple returns and those who want to import data from the tax filing service they used last year; federal is $19.99, state is $36.99

- Deluxe – Best for homeowners and investors; federal is $29.99, state is $36.99

- Premium – For filers with rental property or small businesses; federal is $49.99, state is $36.99

TaxACT

TaxACT offers no-frills, affordable online tax filing software. Compared with TurboTax and H&R Block, they are definitely the underdog, but they make up for lack of frills and brand recognition with prices that are severely lower than their more-well-known competition. TaxACT offers tiers as well, but they are organized by whether state is included or not:

- Free Federal – Free for everyone, State return is $17.99

- Deluxe Federal – Great for filers who want to import their tax data from last year; federal is $12.99 and the first state is $5; additional states are $17.99

- Ultimate Bundle – Both state and federal are included for $17.99,; additional state returns are $17.99

How did they stack up?

Usability & Overall Experience

Each of the online tax filing services had something different to offer. One thing that I thought important to mention about all of them is that they all have accuracy checks built into the process. Before they allow you to file, they check your return for errors and have you fix them before continuing. Error checking is critical and I felt it was one way that all three helped make the process less intimidating. TurboTax and H&R Block also estimate your audit risk. That said, they each had a different flavor and overall experience.

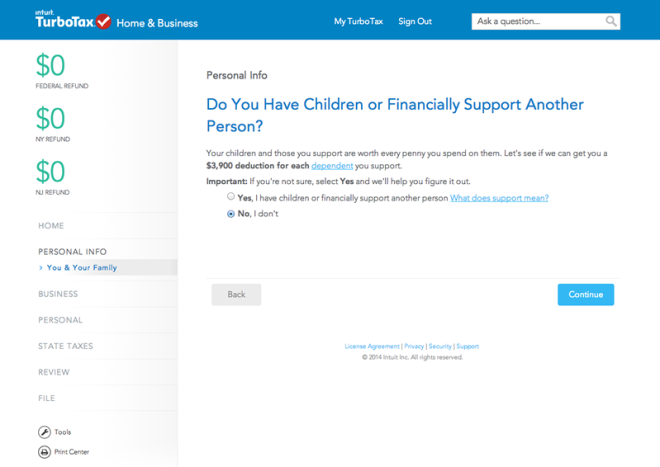

TurboTax

By far, TurboTax offers the best user experience. They go out of their way to make the process as simple and easy as possible. They obviously cover everything that is included in your regular tax forms, but they present the information and questions in such a way that anyone can understand and successfully complete their taxes. As a content strategy nerd in my day-job, I was very impressed on how they presented the questions and all of the supporting information. If there are three choices for a certain form and they know that most people are going to choose one of those, they present the question in terms of “Hey, this is what this is; is this the answer that applies to you?” If it doesn’t, then you have the opportunity to pick one of the more uncommon choices. This is just one of the many examples of how they turned the complex simple and digestible.

H&R Block Online

H&R Block has the second best overall experience. From an accuracy perspective, I wasn’t quite sure they were calculating my return correctly. I moved information to a different part of the form, but it still appeared to be in the first section that I entered it. The refund that H&R Block was drastically different from the other two services, which made me believe that something was not being calculated correctly. However, for a more simple tax return, I feel that H&R Block is usable and helps guide you along in the same way that TurboTax does. While H&R Block makes the complex simple and they highlight things that may be uncommon, I didn’t feel that they took the extra leap that TurboTax took in terms of breaking things down as much as they could and really re-thinking what can be asked to make things more clear.

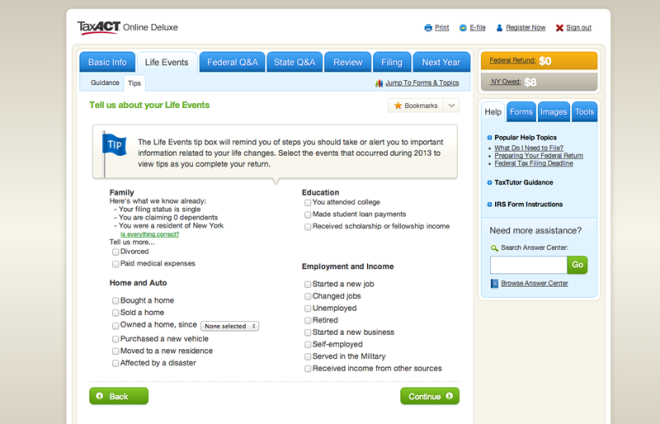

TaxACT

TaxACT certainly was usable, but it departed the least from the actual tax forms that are created by the IRS. For someone who is familiar with the tax forms, this might not be such a big deal. Someone who has never seen or used a tax form before might have a little more trouble completing their taxes, since TaxACT doesn’t transform the questions into a more user-friendly format in the way that TurboTax and H&R Block do. That said, I didn’t experience any issues completing the form and the estimate that TaxACT provided was roughly the same as what I received in TurboTax.

Time to File

All three online tax filing services took me about 1-2 hours to complete, since I had to contend with multiple states and a small amount of freelance income. If you have more complicated taxes, it will probably take you longer. If you don’t have a lot of existing knowledge about completing taxes it might take you longer to get through the screens. If you have super straightforward taxes, it will probably take you less time. To be safe, assume that it could take you 2 to 3 hours, regardless of which online tax filing service you choose.

Cost

As you probably noticed in the descriptions of the services, there is definitely a difference in cost between the three platforms. The winner in terms of affordability is definitely TaxACT. You can’t beat being able to file both your federal and state taxes for $17.99. On the other end of the spectrum, TurboTax is the most expensive. If you are a newbie and not comfortable with your own skills in filling out your tax return, the extra cost for TurboTax or H&R Block might be worth it to you. One great thing about all services is that they let you work on your return before you pay. This is how I was able to test the waters at all three without breaking the bank.

And the winner (for me) is… TaxACT!

While I certainly was impressed by the overall experience of TurboTax and H&R Block, I ultimately ended up filing with TaxACT. As I mentioned above, I was concerned that H&R Block was not giving me an accurate refund amount, because the number differed greatly from both TaxACT and TurboTax. However, the deciding factor came down to cost. I had to file a Schedule C and two state returns. If I had gone with TurboTax, it would have cost me nearly $150! If I had filed with H&R Block, it would have cost $124. With TaxACT, it cost me $36 to file two states plus the federal return. If I didn’t have freelance income or if I only had to file one state, I might have chosen differently. However, due to the fact that I had the same refund amount in both TurboTax and TaxAct, I felt compelled to file with the less expensive (by far) option.